south dakota vehicle sales tax exemption

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

South Dakota Sales Tax Guide For Businesses

Different areas have varying additional sales taxes as well.

. A vehicle is exempt from tax when it is transferred without consideration no money is exchanged between spouses between a parent and child and between siblings. Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

Laws 44-18-30 Gross Receipts Exempt from Sales and Use Taxes South Carolina SC. When Sales Tax Is Exempt in South Dakota South Dakota offers exemption from car sales tax in multiple different situations including. Out-of-state vehicle titled option of licensing in.

In South Dakota the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. There are hereby specifically exempted from the provisions of this chapter and from the computation of the amount of tax imposed by it the gross receipts from sales of tangible. 12-36-2120 Exemptions from sales tax South Carolina Revenue Ruling.

South Dakota Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that. All car sales in South Dakota are subject to the 4 statewide sales tax.

Montana is 21st in WalletHubs rankings of states with the lowest real-estate property taxes but residents pay an average of just 85 in state vehicle property taxes. The highest sales tax is in Roslyn with a. Municipalities may impose a general municipal sales tax rate of up to 2.

But this applies only to vehicles that you will not operate. In the state of south dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Any motor vehicle sold or transferred.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. They may also impose a 1 municipal gross. South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price.

The vehicle is exempt from motor vehicle excise tax under. Mobile Manufactured homes are subject to the 4 initial. 13 rows In South Dakota certain items may be exempt from the sales tax to all consumers not just.

There are limited situations where you can obtain a title without paying motor vehicle sales tax as a buyer. The South Dakota Department of Revenue administers these taxes. How to use sales tax exemption certificates in South Dakota.

This means that you save the sales taxes you. South Dakota Vehicle Sales Tax Exemption.

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

South Dakota Title Application Fill Out And Sign Printable Pdf Template Signnow

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

South Dakota Sales Tax Guide For Businesses

States With No Income Tax Explained Dakotapost

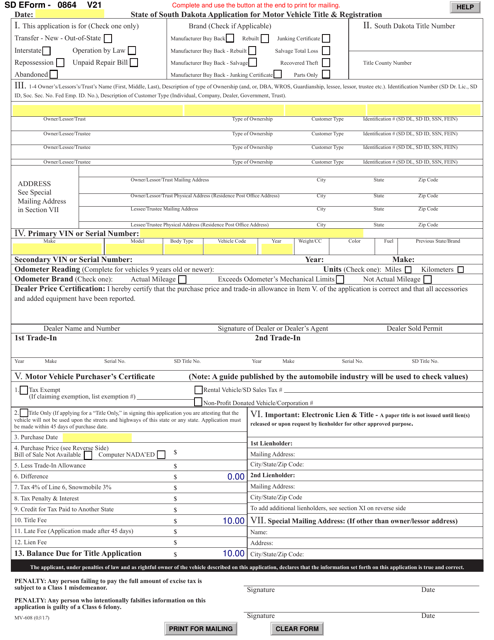

Sd Form 0864 Mv 608 Download Fillable Pdf Or Fill Online Application For Motor Vehicle Title Registration South Dakota Templateroller

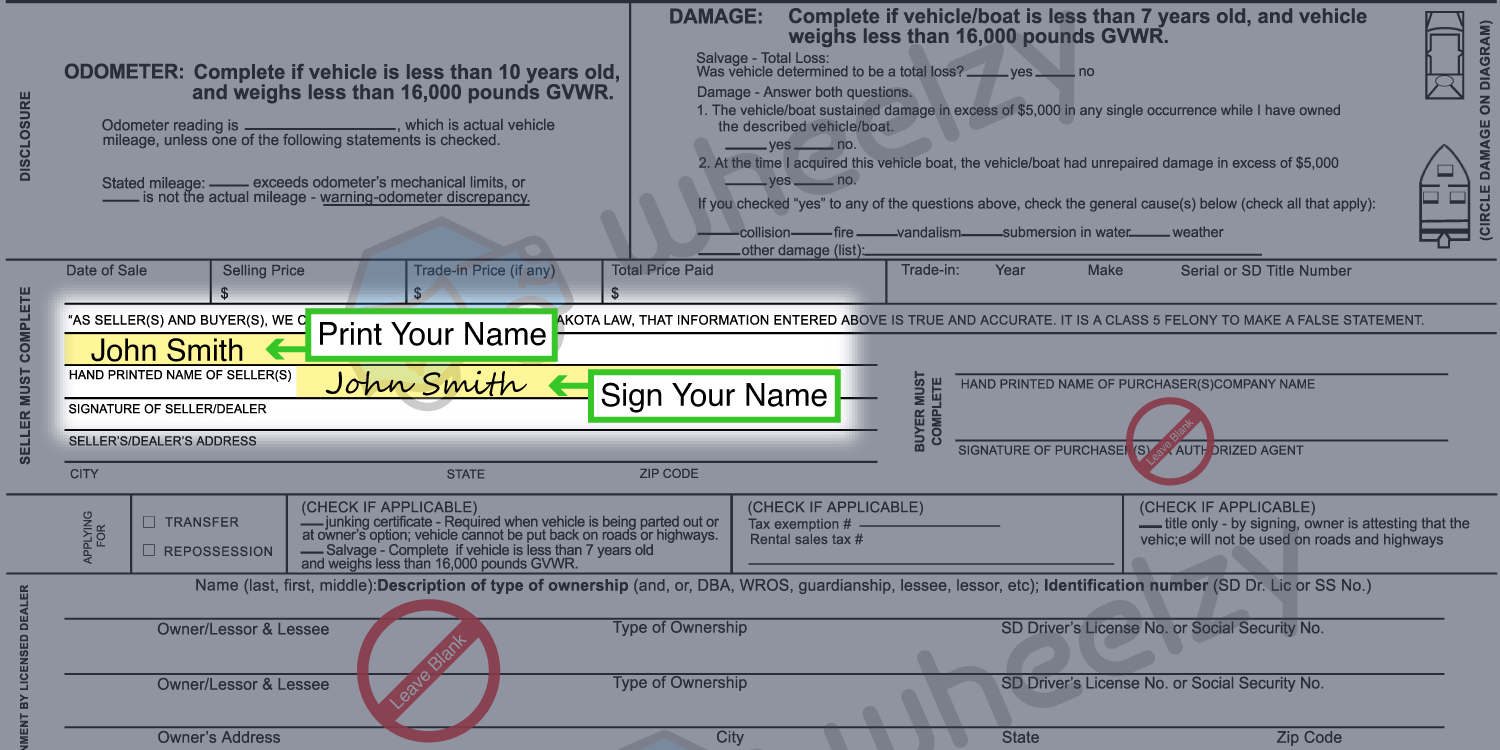

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

Sdform Fill Online Printable Fillable Blank Pdffiller

States With No Sales Tax On Cars

Are There Any States With No Property Tax In 2022 Free Investor Guide

Download Business Forms Premier1supplies

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

Form Rv 093 Fillable Sales Tax Exempt Status Application

Sales Use Tax South Dakota Department Of Revenue

South Dakota Title Transfer How To Sell A Car In South Dakota Quick